Our

Vision

To be leaders in the Australian food industry through thinking differently and being better.

Our

Mission

To understand our customer and solve their problems.

Bespoke Product

DEVELOPMENT

Our mission is to understand our customer and solve their problems by treating customer brands as our own. With 75 years of experience, Cordina continue to bring new concepts to the market and assist our customers to create their own unique point of difference.

Our

sOLUTIONS

Fresh Poultry

Fresh Value Added Poultry

Sous Vide

Oven Cooked

Fried (Coated & Crumbed)

Plant Based

Fresh Poultry

Fresh Value Added Poultry

Sous Vide

Oven Cooked

Fried (Coated & Crumbed)

Plant Based

Our

CUSTOMERS

Retail

We work collaboratively with retailers, using our experience as the experts in value added to create and deliver the best products for you, your brands and your customers.

QSR / Fast Casual dining

We are the partner of choice for many of Australia’s fastest growing brands, who, like us, have a passion for delivering quality innovation that keeps customers returning for more!

Food Service

No matter the channel, we work to deliver consistent, quality products aligned to our customer operational needs and supply chain.

Wholesale

Competitively priced, quality products delivered fresh daily.

Industrial

As a leading food manufacture, we understand the need for innovative ingredients that are consistent in quality and supply.

Export

100% Australian quality grown chicken sourced from our farms.

Retail

We work collaboratively with retailers, using our experience as the experts in value added to create and deliver the best products for you, your brands and your customers.

QSR / Fast Casual dining

We are the partner of choice for many of Australia’s fastest growing brands, who, like us, have a passion for delivering quality innovation that keeps customers returning for more!

Food Service

No matter the channel, we work to deliver consistent, quality products aligned to our customer operational needs and supply chain.

Wholesale

Competitively priced, quality products delivered fresh daily.

Industrial

As a leading food manufacture, we understand the need for innovative ingredients that are consistent in quality and supply.

Export

100% Australian quality grown chicken sourced from our farms.

Our

Company

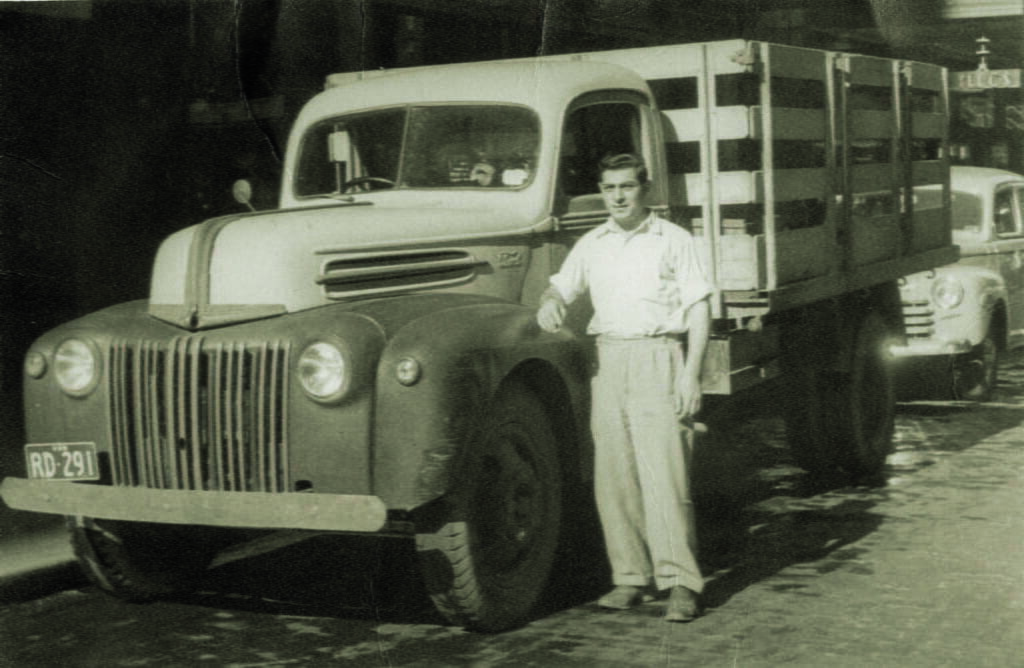

Highly awarded and respected within the food industry, Cordina has built a reputation around partnership, stability, innovation, trust, agility and most importantly, always thinking differently.

Cordina is all about creating bespoke solutions designed purposefully around our customers needs and their brands – in fact, there have now been four generations of Cordina putting the customers brand first.

It’s the service we offer that’s the difference. Our customers can have the whole NPD solution done for them or work in collaboration to bring their new product to life!

Contact Us

Contact Info

Cordina

55 Mandoon Road

Girraween NSW 2145

02 9912 1700

What We Do

Bespoke Product Development

Fresh Poultry

Fresh Value-Added Poultry

Sous Vide

Fried (Coated & Crumbed)

Oven Cooked

Plant Based

Flexible Packaging

WHO WE WORK WITH

Retail

QSR / Fast Casual Dining

Food Service

Wholesale

Industrial

Export

WHO WE ARE

Vision

Mission

History

Locations

Careers

Contact Us

HOW WE CARE

Sustainability

Corporate Social Responsibility

APCO

Animal Welfare